The CAVU Compass: Five Key Questions About the 2024 Economy

![]()

What’s Ahead for the U.S. Economy in 2024?

- This past year has seen the economy move away from the brink of recession, even with many of the most hallowed business cycle indicators flashing warning signals. While the risks of recession have subsided, there remains considerable uncertainty about the economic outlook. Our final report for 2023 looks at five critical questions for the New Year.

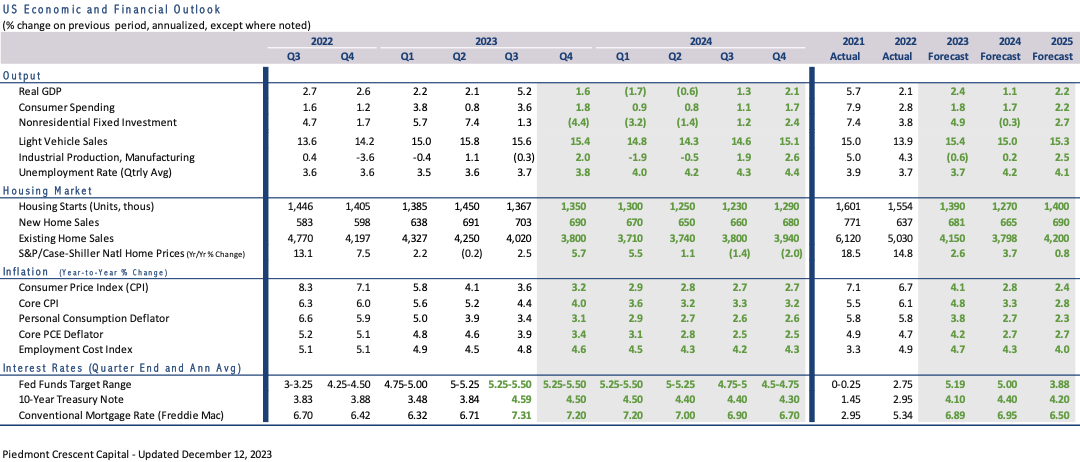

- The first question is just how soft the soft landing will be. We expect real GDP to contract slightly during the first half of 2023 but do not expect the National Bureau of Economic Research (NBER) to label this decline a recession as long as nonfarm employment continues to increase.

- Question 2: Will inflation decelerate enough for the Federal Reserve to cut the federal funds rate? We suspect that it will and look for the Fed to cut the federal funds rate by one-quarter point three times in 2024 beginning in late June, with another cut in September and a third cut following the November election.

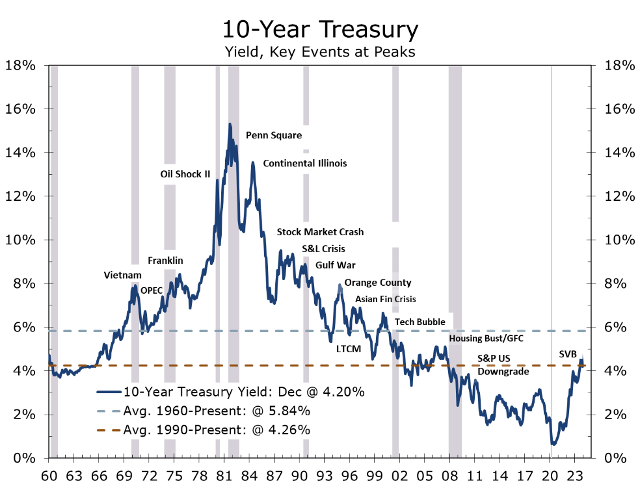

- Question 3: Have long-term interest rates peaked for this cycle? We believe they have but look for the 10-Year Treasury to retrace about half the drop seen since the October CPI report.

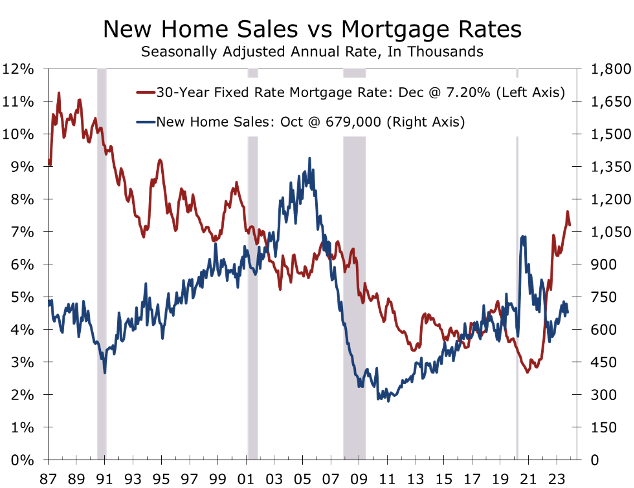

- Question 4: Will the drop in long-term interest rates provide a significant boost to home sales? Yes and no. New home construction will certainly get a boost, but with job growth slowing even fewer existing homeowners are likely to put their homes on the market, further limiting resales.

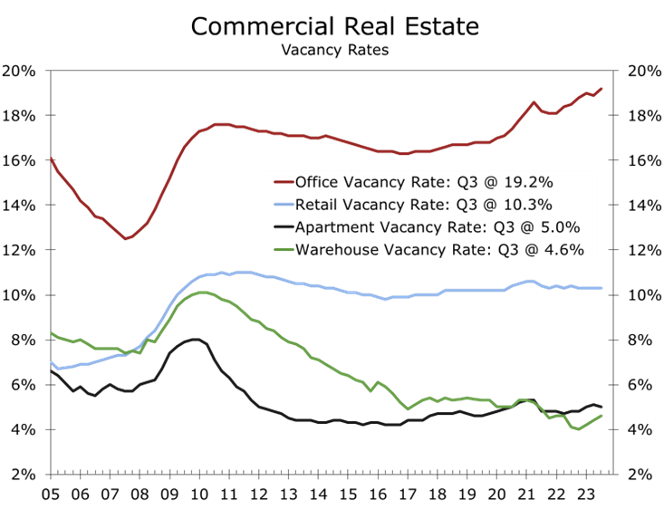

- Question 5: Will Commercial Real Estate deteriorate to the point that it leads to a significant credit crunch? The credit crunch already underway will linger and intensify but credit conditions will not tighten so much that they stifle overall economic growth.

The case for a soft landing was bolstered this past month, which saw the majority of economic data continue to come in on the soft side, while inflation continued to moderate. Fears of recession have subsided, and a majority of economists now see a soft landing in 2024, with real GDP growth slowing below its long-term potential and inflation continuing to moderate towards the Fed’s 2% inflation target. We continue to expect the economy to slow to a pace just a touch softer than a traditional soft landing and expect to see real GDP decline slightly during the first half of 2024. Nonfarm employment is expected to continue to edge higher, however, which we believe will prevent the NBER from labeling this slowdown as an outright recession.

Interpreting the ups and downs of economic activity is unusually difficult today because of the enormous swings in economic activity brought about by the pandemic and the policy response to it. Direct and indirect stimulus to households, businesses, and state and local governments helped fuel a massive economic recovery when the economy reopened following the pandemic. The resurgence led to widespread shortages, which helped drive inflation sharply higher and eventually caused the Fed to aggressively hike interest rates. This past year has seen conditions begin to normalize, as higher interest rates and tightening credit conditions have slowed capital spending, home sales, and consumer spending for big-ticket items. Spending remained strong enough for real GDP to grow 3.0% this past year, a point driven home by the third quarter’s blistering 5.2% annual rate growth.

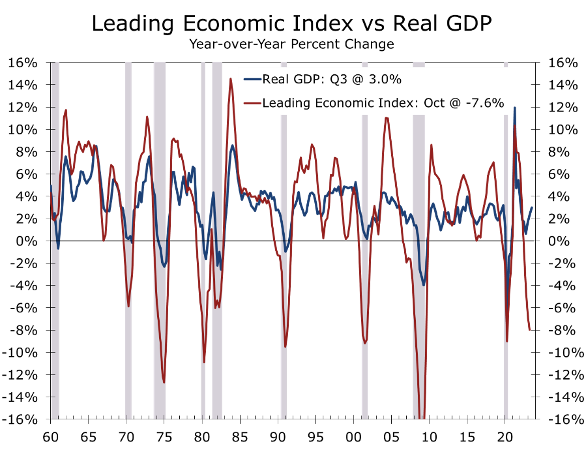

The abrupt swings in economic activity and inflation led to unusually large moves in some of the most hallowed economic indicators. The yield curve, which captures the difference between short-term and long-term interest rates, inverted 17 months ago and has remained inverted. Inverted yield curves have preceded every recession in the modern era, with a typical lag of between 12 and 18 months. In addition, the Leading Economic Indicators index has declined for nineteen consecutive months and is currently 7.6% below its year ago level. The LEI has never fallen this far or for this long without the economy falling into recession.

Source: Bureau of Economic Analysis & The Conference Board

Given the plunge in the LEI, it is surprising that talk of recession has subsided as much as it has. One reason the slide in the LEI may not be as telling as it has been in the past is that several components of the LEI have been distorted by the huge swings in economic activity surrounding the pandemic and its aftermath. The surge in consumer purchases of big-ticket items including furniture, appliances, and home electronics led to a surge in consumer spending, fueling orders and output of the consumer goods, which lifted the LEI as the economy emerged from the pandemic. Goods purchases weakened this past year, however, as spending shifted toward services and experiences. Services and experiences spending does not directly feed into the LEI, so this summer’s strength did not stem the slide in this key indicator.

History suggests it would be a mistake to dismiss the risks of recession associated with the slide in the LEI and the inverted yield curve. After all, banks borrow short-term and lend long-term, which means an inverted yield curve, with short-term rates higher than long-term rates, means bank lending is less profitable. This means banks will lend more selectively and take fewer risks, which slows credit growth and the broader economy.

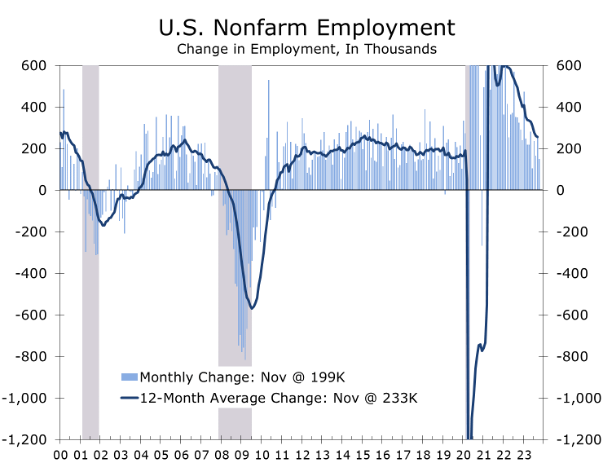

The primary reason so many economists have backed off their calls for a recession is job growth remains remarkably resilient. Employers added 199,000 jobs in November, continuing a string of solid, albeit gradually decelerating job gains. November’s job growth was bolstered by the return of 38,000 workers on strike in the auto sector and motion picture business. As in recent months, Health care (+76,800), government (+49,000), and Leisure and Hospitality (+40,000) accounted for the bulk of job gains. Employment declined in a few notable sectors including Retailing (-38,400), Employment Services (-24,600), Nondurable Goods Manufacturing (-8,000), and Transportation & Warehousing (-5,000). Even with these losses, however, the share of industries adding jobs in November edged higher to 54.6%. Job gains were more widespread a year ago when the private payroll diffusion index was a robust 63.4%.

Source: Bureau of Labor Statistics

While nonfarm employment growth is clearly decelerating, job growth remains strong enough to keep the unemployment rate at the lower end of the range considered to be ‘full employment.’ The number of employed in the household survey surged by 747,000 in November, significantly outstripping a 532,000-person rise in the labor force. The unemployment fell 0.2 percentage points to 3.7%.

We expect hiring to decelerate further in coming months and suspect nonfarm employment is currently overstated. The BLS annual revision to nonfarm payrolls that will be released in early February will reduce payroll growth from April 2022 to April 2023 by 306,000 jobs, or about 0.2%. Job growth has likely decelerated further since then, however. Private sector payroll growth has been revised lower from its initially reported gain every month this year, including a -14,000 job revision to the October data. Even with the downward revision, private employers have added an average of 145,000 jobs a month over the past 3 months. That should provide enough cushion to keep payroll growth in positive territory, even if GDP growth dips slightly into negative territory early next year.

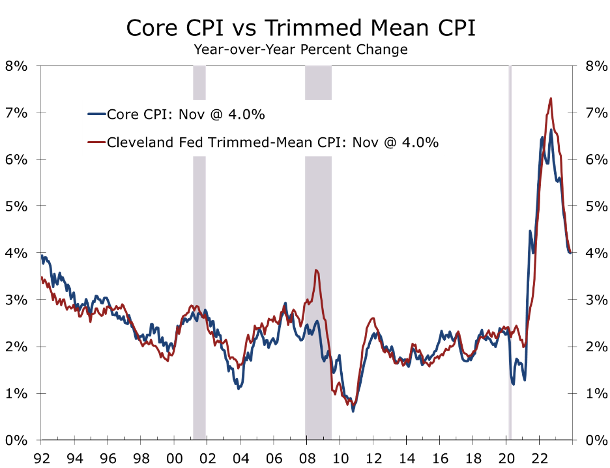

Question 2: Will inflation decelerate enough for the Federal Reserve to cut the federal funds rate? We believe it will. The overall CPI topped out at 9.1% in June 2022 and has fallen back to just 3.1% in November. The bulk of the improvement in the CPI has come from two areas: falling energy prices and a reversal in the spike in used car prices. Price pressures are moderating more broadly. We follow the Trimmed-Mean CPI, produced by the Federal Reserve Bank of Cleveland, which provides a broader picture of inflation than the widely followed core CPI but still excludes outliers. The Trimmed-Mean CPI has moderated along with the core CPI, falling from a recent peak of 7.3% in September 2022 to 4.0% in November of this year.

We expect inflation to continue to decelerate in 2024 but do not look for the core CPI to fall back to the Fed’s 2% target until the latter part of 2025 or later. Even so, the Fed should still be able to reduce the federal funds rate this coming year, however. The real federal funds rate, as measured as the difference between the mid-point of the federal funds rate target (5.50%) and trailing 12-month change in the core CPI (4.0%), is currently 150 basis points. We expect the year-to-year change in the core CPI to decelerate to 3.2% by the end of this year, which should allow the Fed to cut the federal funds rate by a quarter point three times in 2024. We feel the earliest the Fed would cut would be at the June FOMC meeting, followed by another cut in September and then another following the November election.

Source: Bureau of Labor Statistics & Federal Reserve Bank of Cleveland

Question 3: Have long-term interest rates peaked for this cycle? Long-term interest rates have peaked for the cycle but may overshoot to the downside in the rally that followed the better-than-expected inflation data for October and more recent acknowledgment by the Fed that they would likely cut interest rates in 2024. While we expect inflation to continue to decelerate, the improvement this coming year will be less dramatic than this past year. Prices for core services, which are primarily driven by wages, remain more problematic and are likely to improve only modestly this year. Inflation will still improve enough for the Fed to cut interest rates, just not as early as the financial markets are now pricing in and not as aggressively. We look for a maximum of three quarter point cuts in 2024 and four quarter point cuts in 2025. Bond yields will retrace part of their recent declines, rising back to 4.50% and remain slightly above the 4.26% it has averaged for the past 33 years.

Source: Federal Reserve Board

Question 4: Will the drop in long-term interest rates provide a significant boost to home sales? Yes and no. Home buying nearly ground to a halt when mortgage rates briefly spiked up to 8% and there was also a slew of cancelations to previously signed purchase contracts. Now that mortgage rates have fallen back to 7.20%, buyers will return to the market. New home sales and new home construction will certainly get a boost, but with job growth slowing, even fewer existing homeowners are likely to put their homes on the market, which will further limit resales.

Source: Bureau of Economic Analysis

We have a cautious housing forecast for the coming year. Slower job and income growth will weigh on consumer confidence and slow overall home sales. We look for existing home sales to fall 6% from their current levels by the middle of 2024. New home construction will continue to take market share from the existing home market, with the large national home builders faring the best. Home builders are routinely using their incentive budgets to buy down mortgage rates, which is particularly appealing to first-time buyers. That said, we are still looking for new home sales to decline modestly (-4.3%) during the first half of 2024, reflecting slower overall job growth.

Question 5: Will Commercial Real Estate deteriorate to the point that it leads to a significant credit crunch? The credit crunch already underway will linger and intensify but credit conditions will not tighten so much that they stifle overall economic growth. The office market presents the greatest challenge, as office workers have been reluctant to return to the office full-time. Office vacancy rates have climbed steadily this past year as businesses have consolidated their space needs. True vacancy, which would account for leased but vacant space, may be as much as ten percentage points higher than the current 19.2%. We see that as the upper bound, however, as some of this space will be repurposed for other uses.

Attention is now swinging to the apartment and industrial markets, both of which have seen a tremendous amount of new construction in recent years and have a significant pipeline of projects under construction. Lending for new apartment projects tightened this past year and we expect multi-family starts to decline 50% from their 2023 levels. Demand for apartments remains fairly strong and vacancy rates appear manageable at around 5%. Unfortunately, there are close to one million apartments under construction, and demand for apartments will slow as job growth decelerates further in 2024.

The warehouse and industrial market has been one of the top-performing real estate sectors, benefiting from a surge in e-commerce and the recent push for near-shoring. Demand cooled this past year as goods purchases slowed, but vacancy rates remain low at just 4.6%. We expect new construction to moderate next year amidst tighter credit and generally slower economic growth.

Source: Moody’s REIS, Refinitiv

Economic growth has slowed from its torrid third-quarter pace, which saw real GDP grow at a 5.2% annual rate. The widely followed Atlanta Fed GDPNow nowcast, which was one of the first to call for a spike in growth during the third quarter, pegs current growth at just 1.2%. Our forecast is a little higher than that at 1.6%, but much of the growth occurred at the start of the quarter and we expect activity to slow toward the end of the quarter. Holiday retail sales got off to a soft start and we expect spending to rise at the lower end of the 3% to 4% range projected by the National Retail Federation. Sluggish real income growth is holding back spending, although falling gasoline prices are providing a short-term boost to consumer sentiment and buying power.

Our forecast for the first half of 2024 is likely toward the lower end of consensus. We expect to see a preponderance of disappointing economic reports early next year and look for real GDP to decline at a 1.7% annual rate in the first quarter, followed by a 0.6% drop in Q2. Such a decline would be similar to the drop seen at the start of 2022, which the NBER did not label as a recession. This downturn is likely to be more broad-based, but as we noted earlier, we do not expect nonfarm payrolls to post an outright decline. If payrolls do decline, the odds of a recession increase exponentially.

As for interest rates, we feel the bond market has gotten ahead of the Fed. Policymakers will take their time moving from a tightening bias to a neutral bias and finally to an easing bias, which will push the first rate cut out into June. Bond yields will need to rise from current levels to incorporate a slower pace of rate cuts and a higher end point, which we currently see as somewhere around 3.50%. An outright recession would speed this process up and result in a lower endpoint for the federal funds rate, likely closer to 2%.

Disclaimer: This publication has been prepared for informational purposes only and is not intended as a recommendation offer or solicitation with respect to the purchase or sale of any security or other financial product nor does it constitute investment advice. Any forward-looking statements or forecasts are not guaranteed and are subject to change at any time. Information from external sources have not been verified but are generally considered reliable.

© 2023 CAVU Securities, LLC

Questions? Email: CompassReport@cavusecurities.com