The CAVU Compass: Back to Old School on Inflation & Rates

![]()

Old School Course Syllabus

- This past month’s economic data is supportive of the idea that the Fed will achieve a “softish landing.”

- Economic growth during the current quarter is likely to be quite solid, with our point estimate for third-quarter real GDP growth now running at around a 3.5% pace.

- While the odds of a recession have come down, growth is still expected to slow later this year.

- A softish landing means inflation and interest rates will likely remain higher for longer.

- Even when growth slows, the Fed is likely to only begrudgingly lower interest rates, as the Fed leans into the windto gradually bring inflation back to their 2% target.

- Larger federal budget deficits and persistent wage pressure will make the Fed’s job difficult and will pull bond yields higher relative to nominal GDP.

- The combination of slower economic growth, higher interest rates, and higher inflation means budget deficits will likely remain larger for longer.

This past month saw both inflation and nonfarm employment moderate further, strengthening the case for a softish landing. Not only has employment growth moderated but the number of job openings has slowed considerably over the past two months. The inflation data for the past three months also show encouraging signs, with some key inflation gauges running close to the Fed's target. Our forecast still has a recession beginning late this year or early next year, but the odds of either a continuation of the rolling recessions we have seen this year or a 'softish landing', where real GDP declines for a quarter or two but the NBER does not declare an official recession, have clearly improved.

The last week of August brought a slew of economic data that helped clarify how much momentum the economy has. The “second” estimate of second-quarter GDP revealed that growth was not quite as strong as first reported. Real GDP growth now comes in at 2.1%, 0.3 percentage points less than the advance estimate. Downward revisions to inventories and business fixed investment were offset by upward revisions to state and local government spending, exports, consumer spending, federal spending, and residential investment. The following day brought July consumer spending data, which came in much stronger than expected, with real personal consumption climbing 0.6% in July and spending revised up in June as well.

The burst of spending in June and July puts real personal consumption 0.9% above its second-quarter average. This means consumer spending, which accounts for two-thirds of real GDP, will rise at a 3.6% pace if spending is unchanged in both August and September. As it is, we expect to see some payback in August. Spending got a huge boost from record Amazon Prime Day sales. Consumers also spent more freely on travel and entertainment, with concerts and blockbuster movie weekends bolstering service outlays.

The surprising strength in consumer spending caused many economists, including us, to raise estimates for third-quarter real GDP growth. The widely followed Atlanta Fed GDPNow estimate for third-quarter growth rose to 5.9%. Third-quarter growth will not likely be anywhere near that strong. The GDPNow estimate is not an actual forecast by the Atlanta Fed but rather an estimate based on historic relationships between various economic indicators and real GDP growth over time. Our current estimate calls for real GDP to rise at a 3.5% pace in the current quarter. Much of the strength, however, is frontloaded.

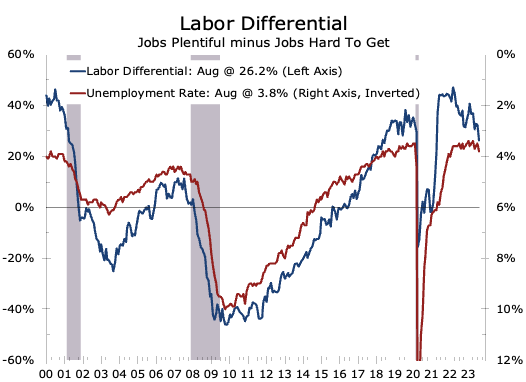

We are already seeing signs economic growth cooled off a bit in August. Consumer confidence fell by a larger-than-expected 7.9 points in August to 106.1. While the overall index remains relatively high, consumers’ assessment of both the current economic situation and future expectations fell meaningfully. Moreover, the proportion of consumers stating jobs were plentiful fell to its lowest level since April 2021, while the proportion that said jobs were hard to get increased. The labor market differential, which takes the difference between these two, also fell to its lowest level since April 2021. The drop would be consistent with an increase in the unemployment rate of just under 4%.

Source: The Conference Board

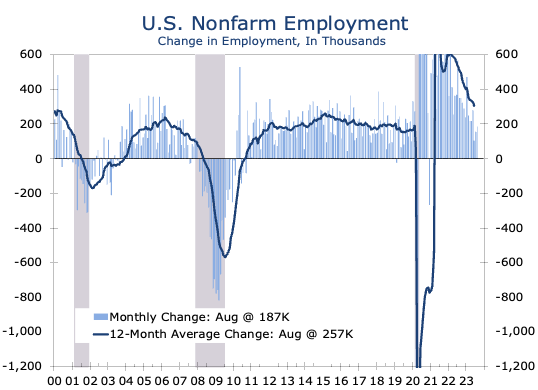

Right on schedule, the labor market data confirmed what consumers were saying. Job growth slowed, the unemployment rate rose, labor force growth increased, and wage gains moderated. When you add in the earlier reported decline in Job Openings, this past month’s employment data checked off every major box on the Fed’s punch list.

Source: Bureau of Labor Statistics

Some analysts were quick to point out that two special factors played a role in holding back August job growth – the shutdown of long-troubled less-than-truckload carrier Yellow Corporation contributed to an outsized 34,000-job loss in transportation and warehousing, and the ongoing Hollywood strike resulted in the loss of 15,000 jobs in the information sector. While this is correct, we feel it is a mistake to simply add these jobs back into the total. For starters, job growth for the prior two months was revised lower by a combined 110,000 jobs. The average gain for the past three months is just 150,000, less than half the average gain of 327,000 jobs during the prior 12 months. Moreover, while the Hollywood/SAG-AFTRA strike is a temporary setback that will almost certainly be reversed once the strike is settled, the losses at Yellow Corporation are more reflective of the ongoing freight recession impacting shippers in general, as well as tightening credit conditions, which are making it harder for financially stressed companies to roll over maturing debt.

Yellow is not the only company that abruptly shut down this past month. Furniture makers Klaussner and Mitchell Gold + Bob Williams also closed permanently in August, wiping out more than 1,400 jobs and continuing a long string of furniture industry cutbacks this year. Business closures in general picked up this summer, including a wide range of businesses including retailers, craft breweries, and restaurants. Job losses will likely take a few more weeks to show up in the employment data but might already be impacting the Job Openings and Labor Turnover (JOLTS) data, which showed a sharp decline in job openings the past two months and also a pronounced drop in the number of voluntary quits. With workers more concerned about job security, wage demands should moderate further.

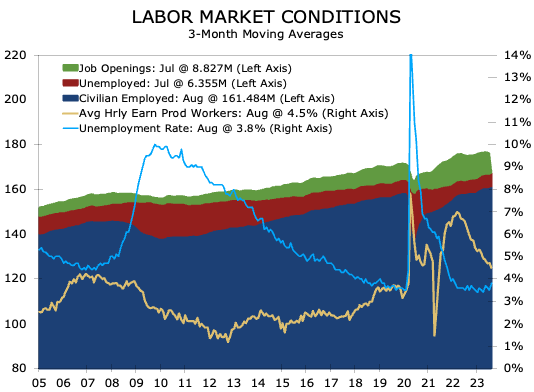

The latest data suggest the rebalancing of the labor market is further along than previously thought. The JOLTS data reported the number of job openings fell by 338,000 in July to 8.837 million jobs. While that still slightly exceeds the 6.355 million unemployed, it marks the lowest number of job openings since March 2021. The number of job openings for the prior month was also revised lower and now clearly appears to be on a downward trend.

Source: Bureau of Economic Analysis

The eye-popping 0.3 percentage point rise in the unemployment rate is not cause for concern. The entire increase is due to a surge in labor force participation, which is another positive step in rebalancing the labor market. The labor force increased by a mammoth 736,000 in August, easily outpacing the 222,000-person rise in civilian employment. The difference between the two shows up as a 514,000-person increase in the number of unemployed.

With a little more slack in the labor market, wage increases can continue to moderate. Average hourly earnings rose just 0.2% in August and are now up 4.3% year-to-year on an overall basis and up 4.5% year-to-year for production workers. The deceleration in wage increases is backed up by survey data from the Atlanta Fed and private sources. Wage pressures are still too high, however, in order to bring inflation back down to the Fed’s 2% target, particularly with labor disputes becoming more frequent and the major motor vehicle producers facing contentious contract negotiations with the United Auto Workers this month. Given recent productivity trends, wage increases would need to be 3.5% or less in order to bring inflation back to 2% on a sustained basis.

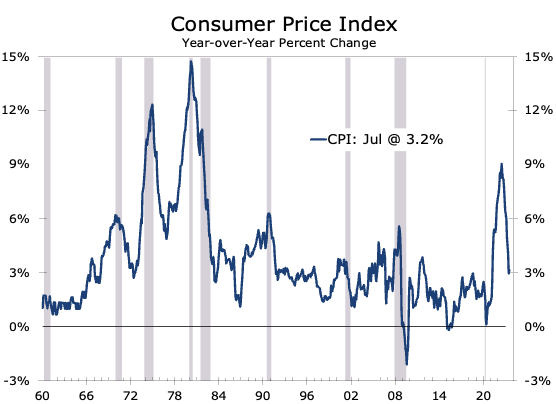

The softer employment data will allow the Fed to hold rates steady at their September FOMC meeting. The consensus view has been that the Fed would take a break from rate hikes at that meeting and a growing proportion of forecasters now believe the Fed has finished hiking interest rates for this cycle. That could certainly be the case, but the Fed’s job is likely to get tougher. The recent improvement in inflation, which has seen the year-to-year change in the CPI fall from 9.1% last June to 3.2% in July, has been overstated. Overall inflation has benefitted from falling oil prices, relatively easy year-to-year comparisons, and a whole host of special factors that have temporarily depressed seasonally adjusted prices for hotels, airfares, and medical care. Oil prices have rebounded more recently, and retail gasoline prices have been rising at a time that they normally would be falling, which might lead to some outsized gains in the coming months. Moreover, the temporary seasonal factors holding back prices on airfares, hotel rooms, and medical care will all reverse this fall.

Those higher inflation readings are likely to show up around the same time the Bureau of Economic Analysis reports blockbuster GDP for the third quarter, which might be enough for the Fed to push through another quarter-point interest rate hike at the November 1 FOMC Meeting. Of more immediate concern, however, is what changes FOMC members make to the Summary of Economic Projections (SEP) released following their September 20th meeting.

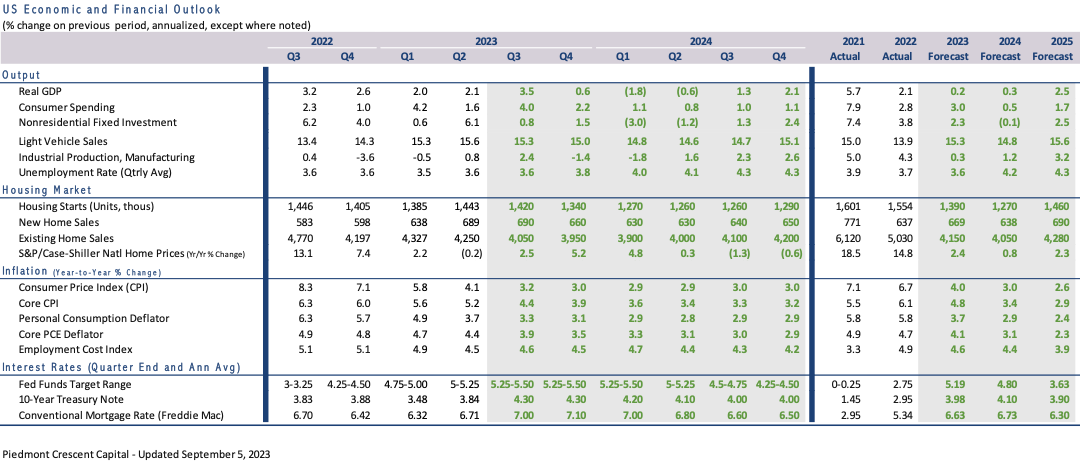

We expect the FOMC estimate for 2023 economic growth to increase, while the estimate for the yearend unemployment rate will likely decline slightly. The median estimate for the year-end federal funds rate is currently 5.60% for this year and 4.60% for 2024, which suggests the Fed will hike the funds rate one more time this year and will cut interest rates at some point next year. We expect the Fed to keep the median federal funds rate where it is for 2023 but slightly raise the rate for 2024 and 2025, as well as their projection for the longer-run federal funds rate, which is currently 2.5%. Both the Central Tendency and Range of participants’ projections rose at the June meeting, which might be a precursor to a rise to 2.7% or 2.8% at the September meeting. This would reinforce the idea that the Federal Reserve is in no hurry to cut interest rates and provide a powerful signal to the financial markets, businesses, and consumers that interest rates will remain higher for longer. The Fed’s SEP will also include projections for 2026 for the first time.

Source: Conference Board and Bureau of Economic Analysis

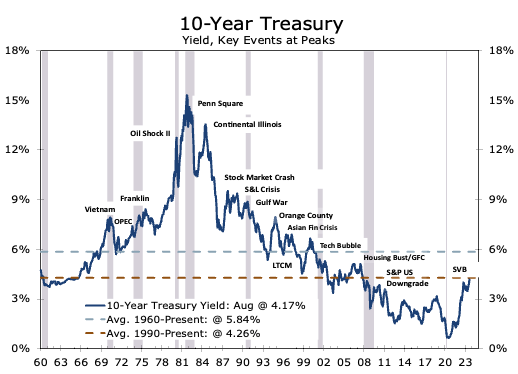

Determining where interest rates are headed long term is a difficult task and involves assumptions on the future course of inflation, demographics, potential real GDP growth, and size of federal budget deficits. We believe inflation will average close to 3% in 2024 and feel the Fed will have a difficult time bringing inflation back down to their 2% target on a sustained basis.

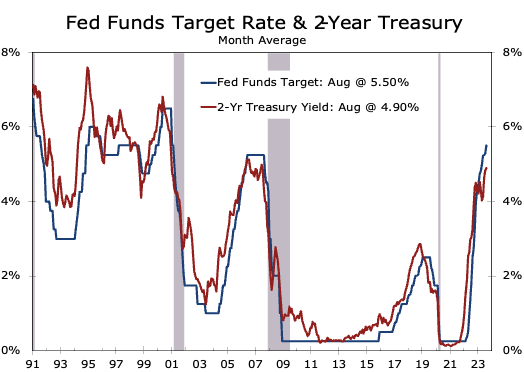

We feel monetary policy is going to go back to old school, with Powell shifting from channeling his inner Volcker to channeling Alan Greenspan. Volcker brought inflation down from double digits in 1980 to 4% by 1985. Greenspan brought inflation down to 2% over the next decade.

Greenspan’s blueprint for bringing inflation down was to lean into the wind by tightening policy more aggressively when the economy was growing solidly, particularly if there was a supply shock that was temporarily suppressing inflation. Moreover, the Fed would be pre-emptive on the upside but would lower rates only reluctantly. This policy came to be known as opportunistic disinflation and we feel a return to this policy over the next few years will be needed to bring inflation back to the Fed’s 2% target on a sustained basis. The federal funds rate averaged about 6.06% from 1985 through 1995.

The mid-1990s brought the advent of the Internet age and subsequent tech boom, which boosted productivity growth and allowed the Fed to follow an easier policy. The federal rate averaged around 4.05% from 1995 through 2007. The funds rate also dropped to a then modern-era low in the aftermath of the September 11 attacks before steadily trekking higher amidst the housing boom.

Source: Federal Reserve Board

The housing bust and ensuing Global Financial Crisis brought in a new policy regime, with the federal funds rate falling to nearly zero and remaining there for the next 8 years. The Fed nudged interest rates slightly higher in 2016 and then began to gradually raise rates in 2017 and 2018, before cutting them amidst slowing growth in 2019. Even including this modest interest rate cycle, the federal funds rate averaged just 0.71% from the end of 2007 to the end of 2019. Of course, the Fed brought the funds rate back down to near zero after the onset of the COVID-19 pandemic and held it there until they began to raise interest rates in March 2022.

Unless the economy is hit with another major calamity, we do not expect the Federal Reserve to drop interest rates to near zero again. Near-zero interest rates defy the laws of economics, encourage speculation, and worsen economic inequality. Near-zero interest rates are also extremely difficult to exit. The Fed is seizing the opportunity they have today, where residual fiscal stimulus from the pandemic and the front-end boost from the Inflation Reduction Act and CHIPS ACT allows them to pursue a more aggressive tightening than they would otherwise.

Source: Federal Reserve Board

Longer term we see the federal funds rates averaging around 3% through the rest of the decade, which is a half percentage point above the Fed’s current estimate for the longer funds rate. A federal funds rate at this level would be consistent with the 10-year Treasury averaging between 4% and 4.25% through the end of the decade, which is well above current consensus estimates but well within historic norms.

Our interest rate forecast is also higher than the Congressional Budget Office, which sees the 10-Year Treasury Note averaging 3.80% between 2023 and 2033. With a normal yield curve, the CBO’s 10-year Treasury forecast works out to a 2.5% average for short-term T-Bills and the federal funds rate. Since the bulk of Treasury financing is done short-term, short-term rates averaging closer to our forecast of 3% would add significantly to the federal budget deficit, which is already projected to rise to a record level relative to GDP.

We have made some slight adjustments to our economic forecast. The most notable is we no longer have a negative quarter for real GDP in 2023. We still see a recession over the next year as more likely than a soft landing, but the odds of the latter have risen while the odds of the former have fallen. We note that the lags between when the yield curve inverts are between 12 and 18 months - 15 months would put the onset of recession in October, and 18 months would put the start of recession in January.

More fundamentally, we expect the economy to slow in response to higher interest rates, tightening credit conditions, and waning fiscal stimulus. Higher interest rates are already weighing on new and used vehicle sales. This summer’s surprising strength in new home sales also looks like it is fading, given the recent slide in mortgage applications. Tighter credit will also lead to more bankruptcies and layoffs, as more companies face difficulty rolling over maturing debt. Additionally, the resumption of student loan repayments may dampen consumer spending, particularly in discretionary services, although it could slightly boost labor force growth.

Disclaimer: This publication has been prepared for informational purposes only and is not intended as a recommendation offer or solicitation with respect to the purchase or sale of any security or other financial product nor does it constitute investment advice. Any forward looking statements or forecasts are notguaranteed and are subject to change at any time. Information from external sources have not been verified but are generally considered reliable.

© 2023 CAVU Securities, LLC

Questions? Email: CompassReport@cavusecurities.com