![]()

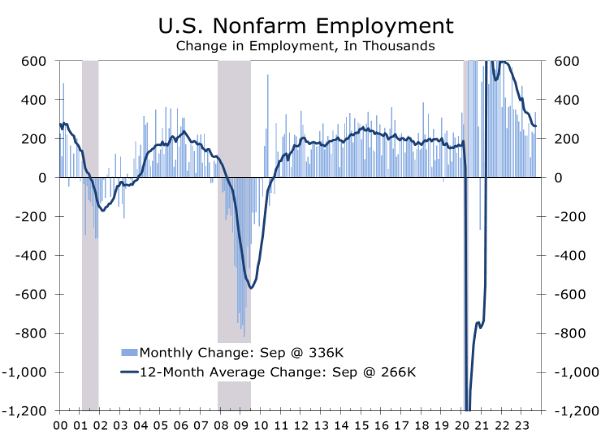

- The third quarter ended on a strong note, with nonfarm employers adding 336,000 jobs in September. Factory orders, output, and consumer spending also remain remarkably resilient.

- Job growth continues to be fueled by industries striving to bring payrolls back up to their pre-pandemic trend, such as leisure and hospitality, and health care. Job growth is likely to remain strong even as economic growth slows.

- Economic growth continues to be fueled by pandemic-era stimulus and initiatives enacted afterward to accelerate the shift to electric vehicles and lessen the nation’s dependence on imported high-end semiconductors and other critical goods.

- While stimulus has helped drive strong economic growth, the bills are coming due. The persistence of large budget deficits is pulling interest rates higher and rattling the stock market.

- The near-term impact of tightening financial conditions has been blunted by all the financing locked up by households and businesses when short-term interest rates were near zero.

- The winding down of pandemic income support programs and the resumption of student loan repayments will modestly restrain consumer spending at the lower end of the income spectrum.

- The attacks on Israel raise the specter of a broader war in the Middle East, which will boost energy prices and increase market volatility. The further tightening in financial conditions is an additional headwind heading into what already looked like a period of slower economic growth.

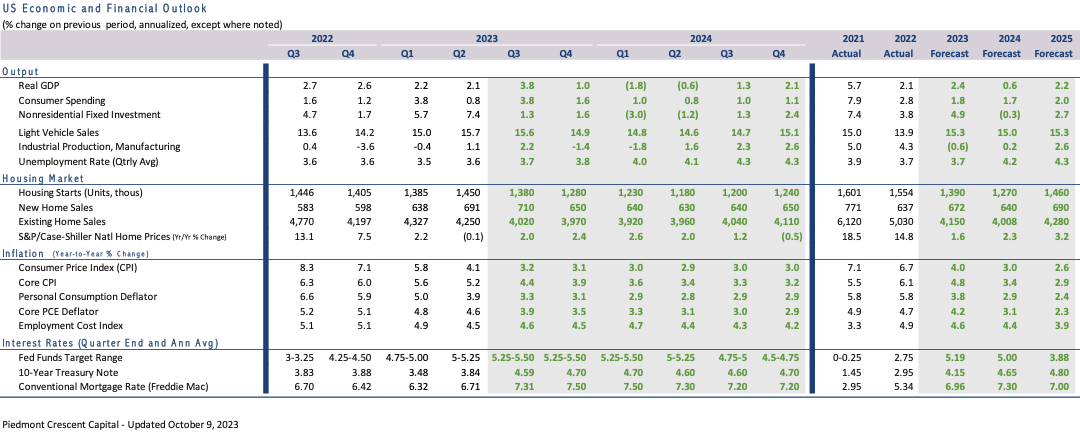

The third quarter ended on a strong note, with employers adding 336,000 jobs in September, and hiring during the prior two months was revised upward by 119,000 jobs. Data on consumer spending, factory orders, and output all continue to show remarkable resiliency, given higher interest rates and tightening credit conditions. We have slightly raised our estimate for Q3 real GDP growth to 3.8% and the risks are weighted toward the upside. Our first look at third quarter GDP will come just ahead of the October 31-November 1 FOMC meeting.

At first blush, the unexpected surge in September job growth diminishes chances of a soft landing, or any landing, and increases the odds of another hike in the federal funds rate. Prior to the September jobs data, Fed officials had been arguing that labor market conditions were cooling off, fueling hopes of a soft landing.

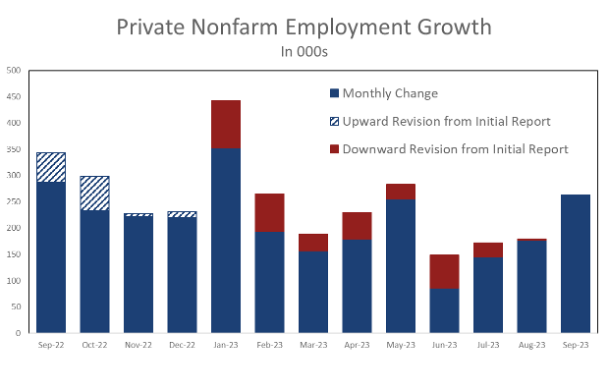

The 119,000-job upward revision to the July and August employment data ended a string of downward revisions to the initially reported overall job figures for every month this year. The downward revisions helped feed the Fed’s narrative that the labor market was losing momentum. At first glance, September’s stronger jobs data came as an unpleasant surprise to the financial markets, particularly following reports of a sharp rise in job openings in the August JOLTS data and continued low readings for weekly first-time unemployment claims.

Source: Bureau of Labor Statistics

Upon closer inspection, September’s jobs report was not quite as strong as the headline rise suggests. While job gains were broad-based, the bulk of job growth continues to come from industries still striving to bring their payrolls back to their pre-pandemic trend. Leisure and hospitality accounted for the largest block of jobs added in September, with hiring at restaurants and bars finally getting back to its February 2020 pre-pandemic level. Many restaurants remain chronically understaffed, however, and industry employment is about 450,000 jobs shy of where it would be today if it had continued to grow at its pre-pandemic pace.

Employment in health care and social services also lags considerably behind its pre-pandemic trend and continues to account for a disproportionate share of monthly job growth. Many of these are doctors’ offices and outpatient care facilities. Nursing homes, home health care agencies, and hospitals are also adding staff.

Hospitality and health care tend to lean heavily toward women, and the recent strength in hiring in these two sectors helps explain the recent strength in female labor force participation. Many of the jobs being created at restaurants and health care are relatively low paid, which is one reason why average hourly earnings have moderated in recent months. The heavier mix of lower-paid jobs means stronger overall job gains will provide less of a boost to income and spending.

State and local government is another sector where employment is still playing catch up. All the upward revisions to the July and August payroll figures were due to more jobs being created than first reported by state and local governments, many of which were in education. We suspect the wide swings in education payrolls during the normally light summer months are due to pandemic-related distortions to seasonal adjustment. Some of the growth, however, reflects the rehiring of administrative positions and support staff, both of which remain historically understaffed. Private-sector payroll growth was revised modestly lower in July and August and has been revised lower every month this year.

Source: Bureau of Labor Statistics

There are likely more downward revisions to come. The Bureau of Labor Statistics released the Quarterly Census of Employment and Wages data in August which is the source data for the annual benchmark revisions reported early each year with the January jobs data. We estimate job growth from April 2022 to March 2023 will be revised down by about 310,000 jobs. By contrast, job growth was revised up by more than 500,000 jobs when the annual revisions were released in February.

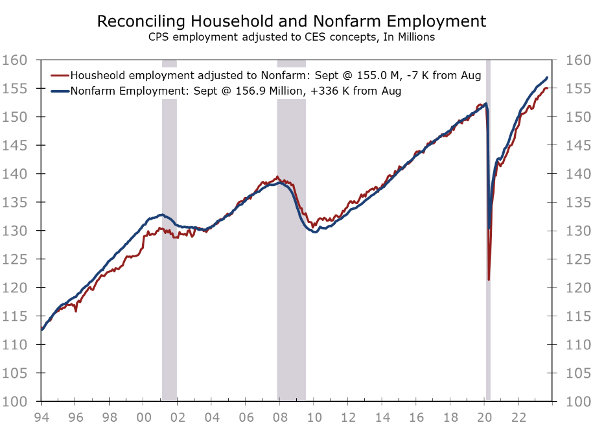

While the impending revisions data only cover the period up to March 2023, we suspect job growth has slowed further since then. The weaker trend is consistent with both the string of recent downward revisions to the preliminary employment data as well as data from the Labor Department’s Household Survey, which is used to compute the unemployment rate. The BLS publishes a series that reconciles the differences between nonfarm employment, which comes from a survey of employers, and the household survey, which comes from a smaller and sometimes more volatile survey of households.

The adjusted household employment data show hiring has been more modest than has been reported by the nonfarm employment series. Moreover, adjusted household employment declined slightly in September. Once the nonfarm data are fully revised, the two series have generally tracked one another very closely. The bottom line is job growth has likely not been as strong as has been reported and is still losing momentum, despite the strong headline-grabbing September job gain reported in early October.

Source: Bureau of Labor Statistics

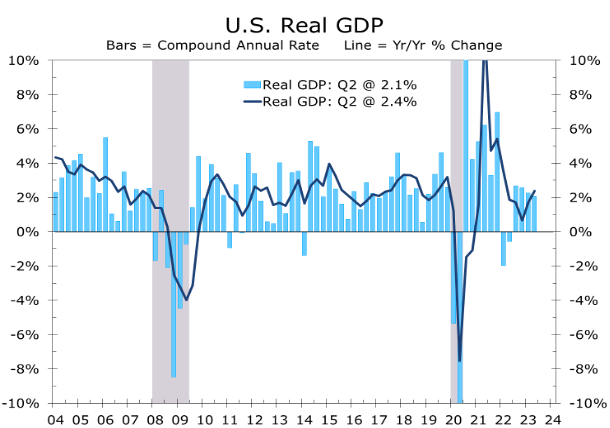

Even after thoroughly dissecting the jobs data, there is no denying the economy grew strongly during the third quarter. Our point estimate calls for real GDP to rise at a 3.8% annual rate during the third quarter, which would mark the strongest gain in more than a year. The risk is clearly to the upside. The Atlanta Fed GDPNow has Q3 real GDP rising at a 4.9% pace. Consumer spending grew solidly, rising at a 3.8% pace or better. Business fixed investment also grew solidly, and the nation’s trade deficit improved as imports slowed. Government spending also likely grew more rapidly, given the large upward revision to government payrolls.

Source: Bureau of Economic Analysis

While third-quarter real GDP growth is widely expected to have been remarkably strong, most of the strength appears to have been at the start of the quarter. Expectations for current quarter economic growth are much more modest, with the consensus estimate for Q4 real GDP growth centered at a 1% annual rate.

Economic headwinds were widely expected to intensify in the fourth quarter of this year, even before the shocking attacks on Israel. One long-running issue is how consumers will react to the restart of student loan repayments, which is likely to impact as much as 10% of all consumers. Higher interest rates are also likely to produce more of a direct drag on growth, as fewer consumers qualify for mortgages and car loans and more businesses have trouble securing financing or rolling over debt.

Bureau of Economic Analysis

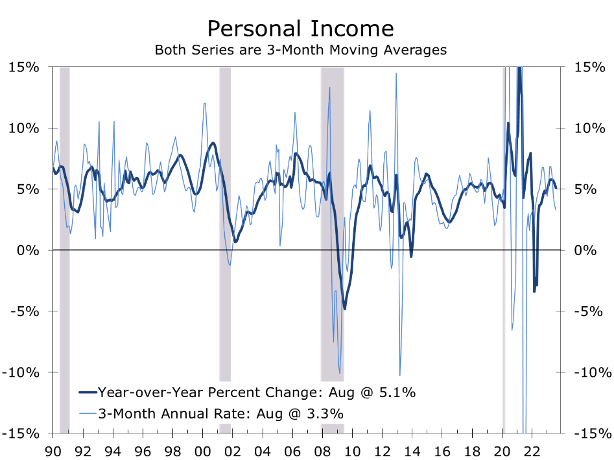

One thing we have learned in following the economy over recent decades is to never underestimate the US consumer. Consumers should have the wherewithal to weather economic headwinds. Personal income grew strongly during the third quarter and revisions to the previously reported data show consumers, overall, still have considerable pandemic-era savings remaining.

While we are optimistic about consumer spending, we have a few concerns. For starters, most of the remaining pandemic-era savings are at upper-income households, who tend to spend a smaller proportion of their incomes. Savings for families earning the median income or less, which is half the households in the country, have largely depleted any savings built up during the pandemic and a now facing the winding down of pandemic-era income support programs. These families are also being impacted more significantly by higher food and energy prices, which has led to increased credit use. Credit conditions are now tightening, as delinquency rates for auto loans and credit cards have risen back above their pre-pandemic levels for younger households and sub-prime borrowers.

Somewhat surprisingly, the resumption of student loans is not at the top of our list of concerns. We expect repayments to surge initially, as higher-income borrowers repay their loans to avoid accumulated interest charges. For the bulk of borrowers, however, repayments will be more closely tied to annual incomes and be more manageable. The income diverted to student loan repayments will come from savings and some pullback in discretionary purchases, such as restaurant dining, concerts, sporting events, and travel.

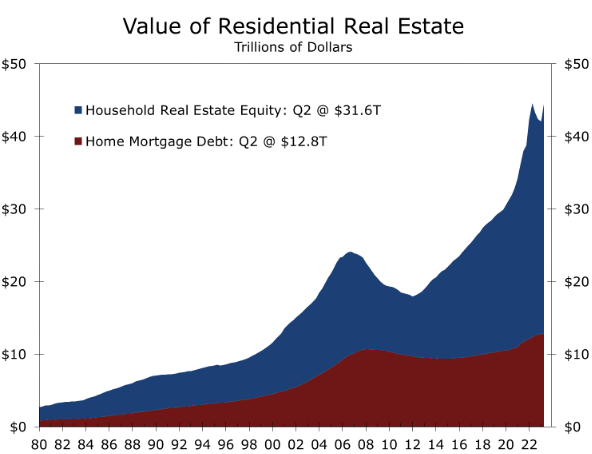

Higher interest rates are less of an immediate threat than they have been in the past. To be certain, higher interest rates will further restrain home sales. Mortgage rates surged to nearly 8% this past month, triggering a spike in contract cancelations for new and existing homes, as many would-be buyers no longer qualify for a mortgage or simply cannot make the numbers work. For homeowners who already own a home, however, rising mortgage rates are less of an immediate concern. Just over 42% of homeowners own their home outright and have no mortgage, while more than 80% of homeowners with a mortgage have a mortgage rate that is fixed below 5%. Another 60% of homeowners with a mortgage have a mortgage rate fixed below 4% and more than 22% have a mortgage rate below 3%.

The preponderance of low-rate mortgages is one of the reasons households accumulated so much home equity during the decade leading up to the pandemic. Households have built up a near-record $31.6 trillion in equity through the second quarter of this year, the second-highest total ever. Much of that equity was built up prior to the pandemic and the more recent surge in home prices. The Global Financial Crisis led to a slew of refinancings at between 3% and 4%, many of which were 15-year fixed-rate loans refinanced under the HARP program in 2010 and 2011. Many of those loans are now approaching maturity, which will add significantly to the share of homeowners who own their homes outright.

Source: Federal Reserve Board

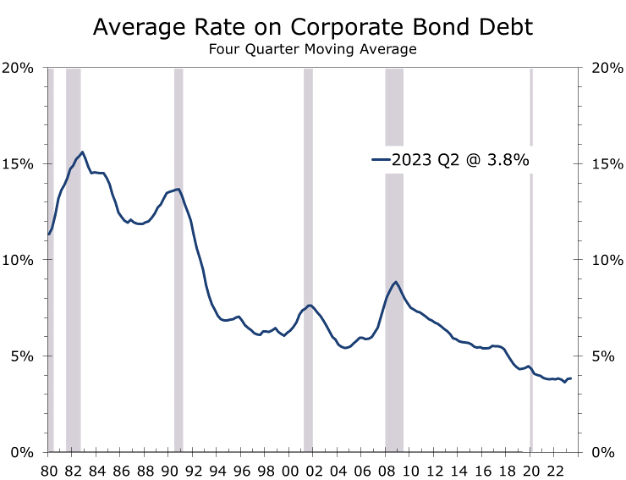

Many businesses are also insulated from higher interest rates, at least in the short term. Many firms were able to lock in financing when short-term interest rates were near zero and the Fed was providing extra liquidity to the bond market during the height of the pandemic. While debt maturities will begin to ramp up next year, much of this debt carries low rates and will not mature until 2025 or later. The average rate on corporate bond debt is currently around 4%.

Source: Federal Reserve Board and Piedmont Crescent Capital

Given the economy’s surprising resilience this summer, the Fed might be inclined to raise interest rates a bit more. Heightened geopolitical uncertainty in the wake of the horrific attacks on Israel, however, will likely keep them on the sidelines, even if the economic data come in stronger ahead of the November FOMC meeting. We are concerned the inflation numbers might come in hotter than expected due to the recent rise in food and energy prices, as well as some catch-up in core services prices, which were suppressed by seasonal adjustment this past summer. Third-quarter GDP growth could also easily top already lofty expectations. If September personal consumption also comes in strong, expectations for fourth-quarter economic growth would increase, which might force the Fed’s hand in November.

We doubt the Fed will hike interest rates any more this year unless a rate hike is already priced into the bond market. Yields have come down in the wake of comments from Fed officials discussing the uncertainty about whether the lags between interest rate increases and their impact on the economy have lengthened, or possibly even weakened, due to the preponderance of fixed-rate debt locked in by households and businesses when interest rates were near zero. That low fixed-rate debt is what contributed to losses in the banking sector earlier this year and even at the Federal Reserve, which was a big part of the initial drag on Gross Domestic Income. Higher interest rates are transferring wealth from lenders, who are holding fixed-rate mortgages and mortgage-backed securities, to borrowers that locked in ultra-low rates. This transfer of wealth appears to be insulating a substantial share of households and businesses from higher interest rates.

We see economic growth slowing over the next three quarters and envision a scenario somewhere between a soft landing and a mild recession. Higher interest rates are having an impact on the most interest rate-sensitive parts of the economy. Sales of new and existing homes are expected to decline modestly over the next 6 to 9 months, as the combination of higher prices and higher interest rates further reduces affordability. New apartment starts are expected to fall sharply, however, accounting for most of the drop in overall housing starts and apartment starts are likely to remain restrained through 2025 due to rising vacancy rates.

Consumer spending will slow but continue to increase on an overall basis. Slower job growth and tightening conditions will reduce big-ticket purchases, with light vehicle sales declining by about 1 million units. We see job growth remaining modestly positive, which is why we are reluctant to label the back-to-back declines in real GDP expected at the start of 2024 as a recession. Even construction employment should hold up reasonably well, due to the unusually large number of homes currently under construction.

Higher interest rates are also making it more difficult for startups and companies that have a long or uncertain path to profitability to raise capital, slowing business fixed investment. Overall nonfarm payroll growth is expected to decelerate to just under 100,000 jobs a month, which will nudge the unemployment rate up to 4.3%. This resiliency will make it harder to bring inflation back down to the Fed’s 2% target. Wages are rising at around a 4.5% pace, which translates into 3% inflation if productivity growth gets back to 1.5%. As a result, the Fed will be slow to cut interest rates even as economic activity slows.

Disclaimer: This publication has been prepared for informational purposes only and is not intended as a recommendation offer or solicitation with respect to the purchase or sale of any security or other financial product nor does it constitute investment advice. Any forward-looking statements or forecasts are notguaranteed and are subject to change at any time. Information from external sources have not been verified but are generally considered reliable. © 2023 CAVU Securities, LLC

Questions? Email: CompassReport@cavusecurities.com