Veterans Play an Outsized Role in the US Economy

- November is National Veterans and Military Families Month, which recognizes and honors veterans, active-duty military members, and their families.

- There are 18.4 million U.S. veterans, which represents roughly 7.2% of the adult population. There are 1.3 million persons currently serving in the U.S. military and another 800,000 reservists. Roughly half of military personnel are married and around 40% have children.

- Gulf War-era veterans now account for the largest share of all U.S. veterans, having surpassed Vietnam-era veterans in 2016. The median age of male veterans still skews older, however, and is approximately 65, while the median age for female veterans is 41.

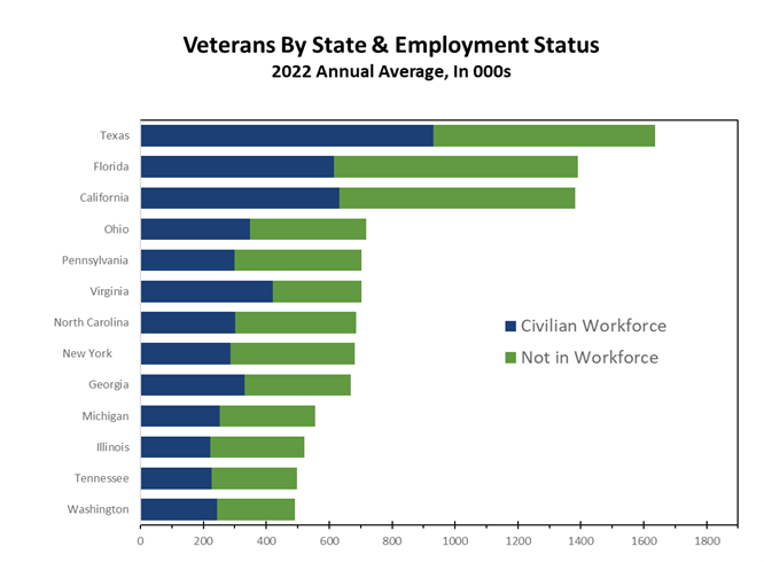

- Given the higher median age of veterans, a large proportion are retired and out of the workforce. A disproportionate share of these retirees resides in states that are home to a large military presence, including Florida, Texas, California, Georgia, Virginia, and the Carolinas.

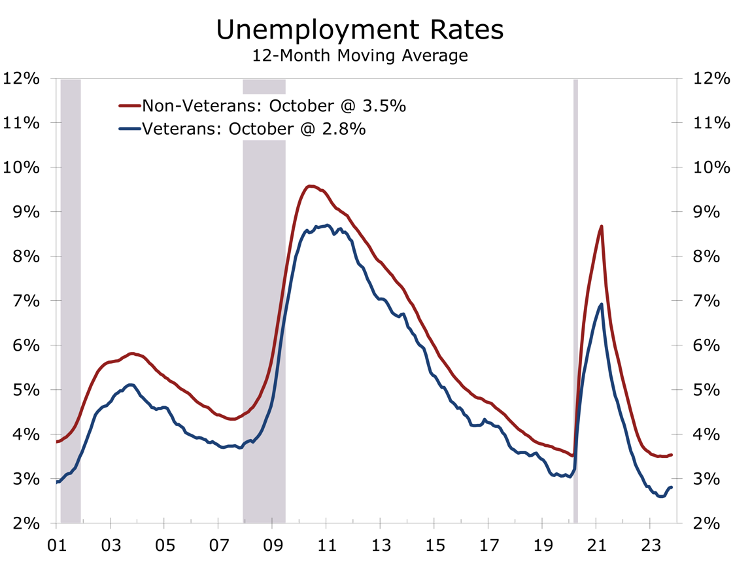

- Veterans have consistently experienced an unemployment rate approximately one percentage point lower than the non-military population. The gap tends to narrow as the labor market tightens. Wages and salaries for prime-working-age male veterans are roughly even with men who have not served, while female veterans earn about 12% more than non-military women.

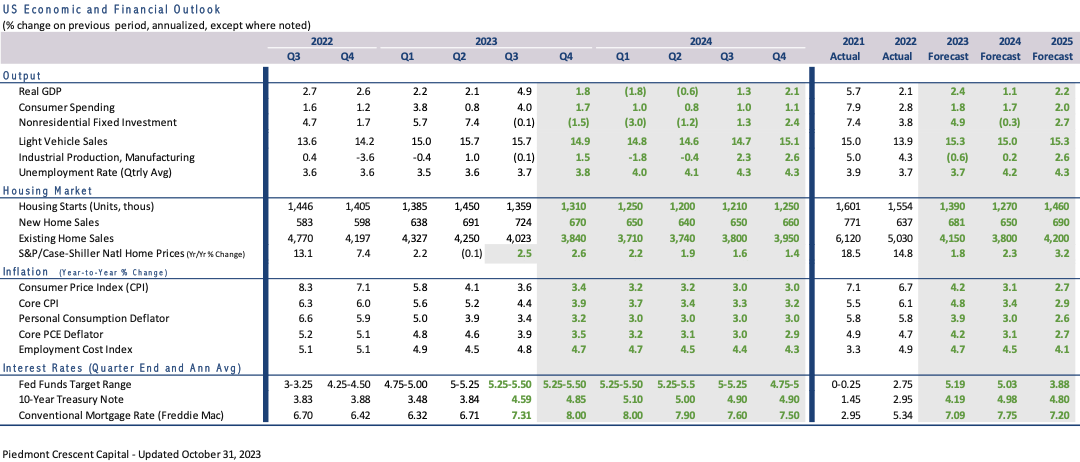

- While this report focuses on the economic contributions of veterans and military families, we include our monthly forecast. Real GDP growth is expected to moderate from its strong Q3 pace but remains solidly positive in the current quarter. The Fed is expected to hold rates steady through the middle of 2024, with higher bond yields doing much of the Fed’s work for them.

November is National Veterans and Military Families Month, which recognizes and honors veterans, active-duty military members, and their families. This month marks the continuing evolution of Veterans Day, which initially honored service personnel who served in wartime. Today Veterans’ Day honors all former service members and Military Families Month honors the sacrifices military families make each year that are particularly noteworthy around the holidays.

The origins of Veterans Day date back to the Armistice that ended hostilities in World War I at 11 a.m. on November 11, 1918 – the eleventh hour of the 11th day of the 11th month. Armistice Day was honored one year later, with ceremonies and parades that continued informally. Congress passed a resolution in 1926 proclaiming that the “recurring anniversary of [November 11, 1918] should be commemorated with thanksgiving and prayer and exercises designed to perpetuate peace through good will and mutual understanding between nations” and asked that the president issue a proclamation each year calling for the observance of Armistice Day. The Day did not become a national holiday, however, until June 1, 1938.

The ranks of veterans swelled tremendously following the massive mobilization of troops to fight World War II, more than 16 million, and the Korean War, around 5.7 million people. Soon afterward, veterans’ groups lobbied Congress to amend the 1938 Act to replace the word Armistice with Veterans. President Eisenhower signed this legislation into law on June 1, 1954. Veterans Day then honored veterans of all wars.

Congress passed the Uniform Monday Holiday Act in 1968, which moved four federal holidays (Washington’s Birthday, Memorial Day, Veterans Day, and Columbus Day) to Mondays. The move was designed to provide federal employees with three-day weekends and encourage travel and tourism. Many states objected to the change, however, as Veterans Day was supposed to commemorate a particular day, and hour for that matter. In 1975, President Ford signed legislation moving Veterans Day back to November 11 beginning in 1978. From that point on, Veterans Day honored all veterans, whether they served in wartime or peacetime.

Military Family Appreciation Month, initiated by the Armed Services YMCA in 1996, serves to honor the sacrifices of military families. Since then, the United States government has consistently recognized this occasion, with the President signing a proclamation each year, officially designating November as Military Family Month. This month is dedicated to acknowledging the daily sacrifices made by military families, who confront distinctive challenges such as enduring extended deployments, frequent relocations, and managing long-term physical and emotional challenges.

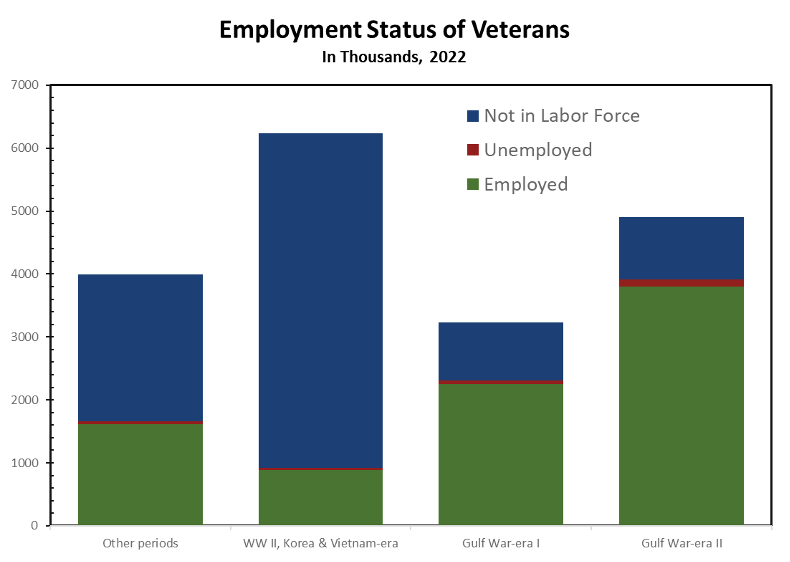

The nation currently has 18.4 million veterans and 1.3 million active-duty service members. In addition, 800,000 people currently serve in the reserves. Gulf War-era veterans now account for the largest share of all U.S. veterans, having surpassed Vietnam-era veterans back in 2016. As of 2022, Gulf War-era veterans include 3.2 million veterans who served from August 1990 to August 2001 (Gulf War-era I) and 4.9 million who served from September 2001 to present (Gulf War-era II).

Source: Bureau of Labor Statistics

The unemployment rate for veterans has consistently remained between one-half and a full percentage point below the unemployment rate for persons who did not serve in the military. Unemployment rates for White and Black veterans were lower than for their nonveteran counterparts in 2022, while the jobless rate for Asian and Hispanic veterans was not statistically different from their nonveteran counterparts.

There are a variety of reasons why the unemployment rate is lower for veterans. For starters, a disproportionate share of veterans are employed by the federal government, a sector less vulnerable to swings in the business cycle. Veterans also tend to be older than the general population, which translates into less turnover. The skills learned in the military are also more valuable to the private sector, particularly for older vets.

Demographics also explain a large part of the lower unemployment rate. This largely reflects the still large population of World War II, Korean War, and Vietnam-era Vets, which numbered just over 6.2 million in 2022, all of which are ages 65 or over. Most Vets from this era are no longer in the workforce, and many have retired to warmer climates that have an abundance of military facilities that can be used by Vets. With so many veterans out of the workforce, the overall labor force participation rate, which is the proportion of the civilian population that is either working or looking for work (47.9%), is nearly 17 points lower than it is for non-veterans.

The unemployment rate for younger veterans is higher than for non-veterans. The jobless rate for veterans aged 18 to 24 in 2022 was 8.8%, a full percentage point higher than for their nonveteran counterparts. The unemployment rate for veterans aged 25 to 34 was 4.0%, roughly even with those who did not serve in that age group. Among prime working-age persons, the unemployment rate for veterans is lower than for their nonveteran counterparts even though labor force participation is higher. The jobless rates for veterans aged 35 to 44 (2.3%), 45 to 54 (2.2%), and 55 to 64 (2.3%) are all below their nonveteran counterparts.

The lower unemployment rates for prime working-age veterans are even more striking as it has come along with higher labor force participation. The labor force participation rate for prime working-age veterans (age 25 to 54) was 83.2% in 2022, compared to 82.4% for nonveterans. Labor force participation for Vets aged 65 and over was just 15.3% in 2022, 4.6 percentage points lower than for their nonveteran counterparts.

Source: Bureau of Labor Statistics

Military retirement benefits earned by veterans undoubtedly contribute to the lower labor force participation rates for older veterans. Many have retired to states in warmer climates that also maintain a large military presence, including Florida, Texas, California, Georgia, Virginia, and the Carolinas. Florida and Texas do not have an income tax, which allows retirement dollars to go further. The Northeast and Midwest are also home to a large contingent of veterans, many of whom are now retired.

The influx of military retirees is a stabilizing influence on local economies. Military retirement payments continue both in good and bad economic times. Veterans also provide local economies with valuable skill sets that are put to use in the labor force or in volunteer work. The benefits of military retirees have prompted many states to exempt military retirement pay from state income tax, hoping to put their states on a better footing to compete with Texas and Florida for the large pool of military retirees. Among the 42 states that have an income tax, 26 do not tax military retirement pay and 9 others only partially tax military pay.

Source: Labor of Statistics

Avoiding taxes is not the only reason veterans locate in one state or another. The climate, availability of resources provided to veterans, and cost of living are also important variables. Prime working-age veterans also tend to locate where they have a relative abundance of job opportunities. Virginia, Maryland, Alabama, and North Dakota are notable standouts on this front. All four states boast unemployment rates for veterans that are below 2%, despite having significantly higher labor force participation rates for veterans. North Dakota had the lowest unemployment rate for veterans in 2022 at just 0.7%, with 55.5% of veterans in the workforce. Virginia has the highest share of veterans in the workforce, at 59.7%, which is more than 10 percentage points higher than the national average of 47.9%.

One thing all four states have in common is that the federal government is a major employer in the state. Veterans are much more likely to work for the federal government than nonveterans, with 10.8% of veterans working for the federal government in 2022, more than five times more than nonveterans (2.1%). Employment of veterans at other levels of government is similar to nonveterans, with 4.6% (the same as nonveterans) working in state government and 7.4% (1 percentage point more than nonveterans) working in local government.

The prevalence of veterans in government is due to the unique skill sets veterans bring to the job. While workers in combat specialty positions may have few direct skills transferable to the private sector, the ability to follow instructions, complete a mission, and be accountable is valuable in nearly every occupation. The military employs a large number of workers in professional, scientific, and professional roles that are particularly sought out by federal government contractors that proliferate the areas surrounding Virginia and Maryland suburbs surrounding Washington D.C. and Alabama.

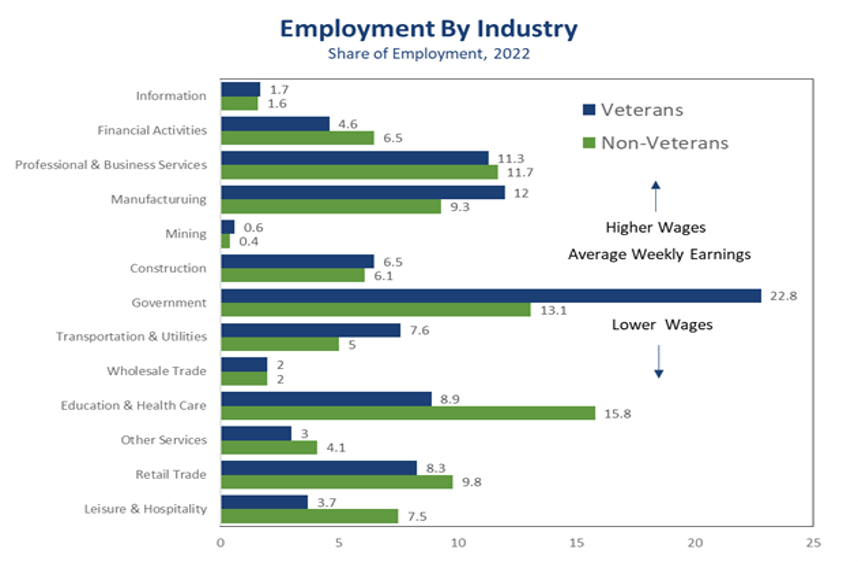

Other occupations military personnel perform that develop skills easily transferable to the private sector include vehicle and machinery mechanics, transportation and materials handling, electrical and electronic equipment repair, health care, protective services, and construction. The skill set veterans bring to the workforce is weighted toward higher-paying occupations. A higher share of veterans work in manufacturing, construction, and mining. In addition, an outsized share of veterans work in transportation, logistics, and utilities. Veterans are generally underrepresented in lower-paying occupations, such as food services, retail trade, personal services, and administrative positions in health care and private education.

The mix of jobs means working veterans earn slightly more than nonveterans. Nearly all the discrepancy is with women. Female veterans earn approximately 12% more than nonveterans, as fewer female veterans work in lower-paying occupations that tend to predominantly employ women, including many occupations in food service, retail trade, and lower-paying occupations in health care and social services, such as childcare. Earnings for prime working-age veterans are slightly higher than nonveterans, primarily due to the larger proportion of workers in manufacturing, construction, mining, and government. Veterans working in transportation and logistics and at utilities also tend to be older and more highly skilled and experienced, which means they are more likely to work in more highly compensated occupations in these sectors.

Source: Bureau of Labor Satistics

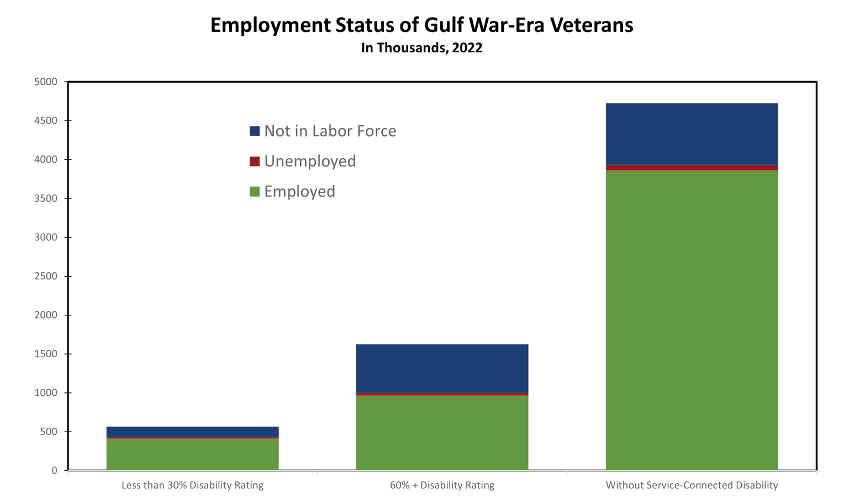

Just over 2.9 million Gulf War-era veterans have a service-connected disability, accounting for slightly over 60% of veterans with a service disability. Veterans with a service-connected disability are assigned a disability rating by the U.S. Department of Veteran Affairs or the Department of Defense ranging from 0 to 100 percent in increments of 10 percentage points. Among veterans with a service-connected disability, 23% reported a disability rating of less than 30%, while 50% reported a disability rating of 60% or more. The numbers are slightly different for Gulf War-era veterans, with 19% reporting a disability rating of less than 30% and a larger 55% reporting a disability rating of 60% or more.

Labor force participation for veterans with a disability rating of less than 30% is roughly equivalent to that of veterans overall, at around 77%, but well below the share of Gulf-War-era veterans without a service-connected disability (83.3%). The unemployment rate for Gulf War-era veterans with a service-connected disability is 3.6%, which is notably higher than for Gulf War-era veterans without a disability (1.9%). Gulf War-era veterans with a disability rating of less than 30% have a higher unemployment rate (4.7%) than those with veterans with a disability rating above 60%, which was 4%. The reason for the lower unemployment rate is that a larger share of veterans with a disability rating of 60% or more are not in the labor force.

Source: Bureau of Labor Statistics

The military contributes mightily to the American labor market, with 1.3 million people serving in the active military and another 800,000 serving in the reserves. Moreover, the military employs some 730,000 civilian workers and about 500,000 civilian contractors. These numbers have come down considerably in recent years as U.S. involvement in wars has drawn down in the Middle East and Central Asia. Given the state of the world, we suspect the military will remain at its current size in the coming years. In addition to the contribution of military personnel, approximately half of veterans are married and 40% have children. Military families make enormous sacrifices, dealing with frequent relocations and deployments, which are particularly notable around the holidays. Military spouses also endure higher unemployment and lower earnings on average. We honor that commitment and sacrifice in National Military Family Month.

Veterans also contribute significantly to the labor market, by adding a large number of skilled workers that are sorely needed in a variety of occupations. Prime working-age veterans participate in the labor force in roughly the same proportion or more than those who have not served in the military and tend to earn slightly more. The gap largely reflects the older average age and greater work experience of veterans as well as the prevalence of employment in higher-paying occupations.

Most of the pay differential is for female vets, a much lower share of whom work in lower-paying occupations than non-vets. Gulf War-era veterans with a service-connected disability also continue to contribute to the labor market, with those with a disability rating of less than 30% participating in the labor force at the same rate as veterans overall, and 61.8% of Gulf-War-era veterans with a disability ratio 60% or more either working or actively looking for work.

The number of veterans will decline from 18.4 million today to around 12.5 million over the next 25 years, reflecting the passing of World War II, Korean War, and Vietnam-era veterans, as well as the smaller size of the U.S. military. Vietnam-era veterans are all currently over 65. The share of female veterans will increase over the next 25 years, rising from its current 11% to around 17.5%.

We have updated our forecast to include the latest GDP data. Real GDP growth topped most estimates during the third quarter, with consumer spending rising at a 4.0% annual rate. The increase reflects a surge in spending on travel and leisure, which is unlikely to carry forward in the current quarter. Overall growth is expected to moderate in the current quarter and decline modestly during the first half of 2024. Slower economic growth will keep the Fed on hold, even though inflation will remain above the Fed’s 2% target.

Disclaimer: This publication has been prepared for informational purposes only and is not intended as a recommendation, offer, or solicitation with respect to the purchase or sale of any security or other financial product nor does it constitute investment advice. Any forward-looking statements or forecasts are notguaranteed and are subject to change at any time. Information from external sources have not been verified but are generally considered reliable.

© 2023 CAVU Securities, LLC